Access insights and articles to help you navigate the world of education and investments.

EDUCATION AND INVESTMENT

Online learning increases cost of education.

The COVID-19 pandemic turned our lifestyle around, with shockwaves being felt across almost every aspect of our life. Education was no exception, leading to consequences of its own.

In a January 2021 Futurity survey, parents of school-going children across Australia said that school closures owing to lockdowns and online learning has put them under financial pressure.

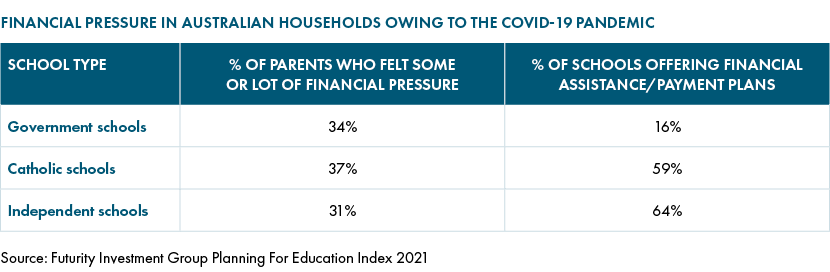

Futurity’s research on the financial impact of COVID-19 revealed that around one-third of parents who send their children to Government, Catholic or Independent schools across Australia felt some or a lot of financial pressure as a result of the COVID-19 pandemic.

Parents spent an average of an additional $808 per child on education-related expenses owing to the pandemic in 2020* increasing the overall cost of education. The expenses included:

- electronic devices - $336

- outside tuition and coaching - $202

- additional stationery - $111

- additional textbooks - $99.

Get an up-to-date estimate of the real cost of education for your child using the Futurity Cost Calculator.

Kate Hill, Futurity Group Executive, said that more than ever, the costs associated with education are placing more of a burden on Australian families, who are already stretched by the rising cost of living and stagnant wage growth. “COVID-19 has only exacerbated this financial challenge, with parents required to spend hundreds of dollars extra on unplanned education-related expenses at the height of the pandemic,” Ms Hill said.

Schools offer financial assistance

Understanding the pain of parents, schools across Australia offered financial assistance/payment plans for paying the school fees during the COVID-19 pandemic. In fact, Futurity has seen an uptake of our education loans by schools across the nation.

Financial pressure in Australian households owing to the COVID-19 pandemic

Implications of online learning on the productivity of parents.

Online learning also had major implications on parents’ capacities to work. There was a reduction in the productivity of parents while supporting the online learning of children during COVID-19 due to:

- increased cognitive load of switching between work tasks and children’s schoolwork

- stress of balancing work and caring responsibilities

- increased cognitive load due to noise from parents and children working and learning from home

- inefficiencies due to cluttered and cramped workspaces for parents and children.

Futurity’s analysis of the parents’ survey revealed that 46% of Government school parents spent more than two hours a day to support their child’s learning during the school lockdowns. This dropped to 36% among parents of children in Catholic schools and 33% among Independent school parents.

More than one in four (27%) Government and Catholic school parents reported taking annual leave or unpaid leave during the pandemic to help educate their child at home, compared to 22% of Independent school parents.

Parents squeezed between financial pressure and caring responsibilities

What’s more, the combination of financial pressures and caring responsibilities has spiked the mental distress levels of Australian parents to alarming levels. Research shows that employed parents whose youngest child is aged five to 11 are more distressed than non-employed parents.

The mental distress of this cohort surged from 7% in pre-COVID times to 18%, experiencing the highest level and strongest increase in mental distress. Of the 1.5 million Australians in this demographic over a quarter are estimated to experience high mental distress.

One suggestion is for the government to offer targeted financial support for non-employed parents in the expectation that it will ease financial pressure and help decrease mental distress. This may or may not be the government’s priority as they battle other pandemic-related issues. In the meantime, planning for the cost of education and to meet unexpected education-related expenses can help put your mind at ease while preparing for the uncertain road ahead.

Take the first step by calculating the true cost of education for your child.

*Source: Futurity Investment Group Planning For Education Index 2021