Access insights and articles to help you navigate the world of education and investments.

Investment and Education

Inflation and the cost of education

When inflation is high, the cost of living can skyrocket. We feel the impact on groceries, fuel and utilities bills, but less obvious is the effect on the cost of education, and particularly HECS debt and HELP debt. These debts are indexed, which makes inflation a concern.

Parents want to help

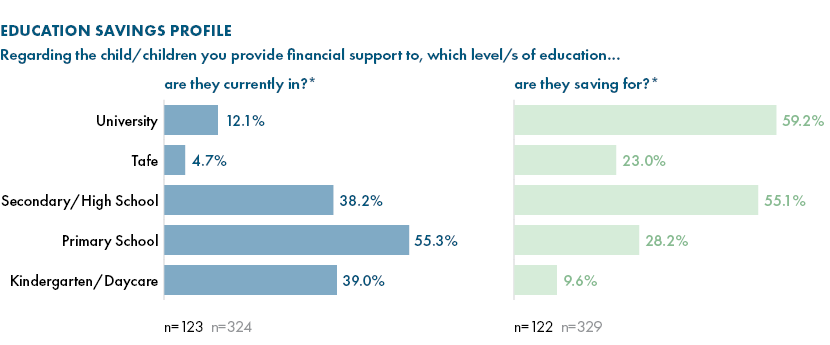

According to Forethought research commissioned by Futurity, many Australians are saving for their children’s secondary school and university education.

Of course, there are a long list of immediate costs that apply to secondary schooling. A private secondary education incurs fees, but even in the public system, outlays such as equipment, books and clothing can add up.

But some might question why parents and grandparents are saving for higher education, when Australians have access to the HECS-HELP government higher education loan program. The answer has to do with long-term debt, and inflation’s effect on it.

It’s an impact that might go unnoticed… but not unfelt. HECS and HELP debt is indexed to the Consumer Price Index (CPI). This mean the debt rises in line with inflation… an impact that continues until the debt is paid off.

HECS debt and HELP debt can be hard to shake

HECS-HELP isn’t free money; it’s most often a long-term debt. With the average HECS-HELP debt balance of $22,636 taking an average of 9.5 years to pay off, it can impact important milestones such as buying property, getting married and starting a family.

Key life decisions like buying your first home or starting a business, require a significant financial contribution and HECS repayments can certainly affect your bank balance. Importantly, banks and other lenders also take HELP-HECS debt into consideration when calculating borrowers’ capacity to repay debt, meaning it is becoming increasing difficult for recent graduates to borrow for a home or business.

Because HECS debt is linked to the CPI, financial and social impacts can be compounded in times of high inflation and stalling wage growth. In this perfect storm, the debt balance can grow larger even while repayments are being made.

Unfortunately, we’re right now in the midst of this perfect storm. Inflation is currently at 7.8%1, while wage growth is at 3.3%2. If this trajectory continues, impacts will only grow.

The latest release from the Australian Bureau of Statistics (ABS) CPI update, show there has been the highest rise in education costs in five years. With tertiary education cost rising 9.7%*.

There are targeted strategies to save for the cost of education

Those who want to support loved ones through education, whether secondary, tertiary or at any point along their lifelong learning journey, need a strong, tax-effective plan. But it can be hard to know where to start. Which savings vehicles are a good fit?

Bearing in mind Education Bonds unique tax benefits, this result may reflect a lack of knowledge. With so many different savings vehicles and loan options available, it’s understandable parents and grandparents may not be aware of all their options.

We can help

We’re here to help those who are planning and want to save for a child’s future. With Futurity’s range of Education Bonds, parents and grandparents can tax-effectively save and invest to help cover the cost of university… and all learning before and after.

To learn more about how you can help lessen the impact of inflation on education with tax-effective investing, speak with your financial adviser about the Futurity Education Bond range. Or get in touch with us.