You can read the latest articles and insights to help you understand the strategic uses of Education Bonds to provide the best financial advice to your clients.

Unlock potential

The simple way to pass on wealth exactly as intended

One of the fastest growing areas of advice that people are seeking information on, is in relation to intergenerational wealth transfer. As a financial adviser, this comes as no great surprise given we shared that $3.5 trillion in wealth is set to be transferred to younger generations over the next 20 years*.

So your clients are seeking out investments that can achieve multiple outcomes or goals, as part of their mix in a comprehensive financial plan. We’ve discussed this in our article on tax-effectively accumulating and protecting wealth and some of the common goals that your clients may be seeking can include:

- protecting their wealth

- investing in tax-effective solutions

- providing for their children or grandchildren’s future, and

- passing on wealth exactly as intended

An investment solution that can cater for all of the above and more is a Futurity Education Bond. Don’t be put off by its name, this type of Bond is a highly tax-effective way of not just catering for lifelong education funding, but also offer a solution for a range of other life event financial needs.

As a tax-effective way to accumulate and distribute wealth for any purpose, we take a look at the benefits of using Education Bonds for estate planning. As they can make a much simpler alternative to family trusts and deceased estate arrangements.

Secure estate planning

By using a Futurity Education Bond, your clients can plan with certainty for how and when their wealth will be distributed to the next generation. This is something that has become increasingly important as we’ve seen the rise in blended families, marriage breakdowns and family disputes, which has meant we are now seeing a rise in the amount of Will’s being disputed. Having an estate planning solution that helps to ensure wealth is passed on as intended is more important than ever for your clients. Some of the estate planning features that make Education Bonds an attractive option include:

- Bonds can be owned by individuals (single or multiple), a company or trust (including deceased estates). Providing flexibility to structure estate planning according to the exact needs of your clients.

- Will-like Bond Estate Nominations can be made to achieve tax-effective inheritances. Bond proceeds can be distributed to the Bond Owner’s nominees without the cost and complications (and potential legal challenges) of Wills and estates.

- Bond ownership can be transferred at any time with full retention of the Bond’s tax-advantaged status. Bond Owners can also use a Future Activated Transfer feature to set a future date or event (such as death) to transfer their Bond to someone else. This is an incredibly valuable tool for both intergenerational wealth transfer and education provisioning.

- A Bond Guardian can be appointed to act for the Bond Owner in event of their death, legal, physical, or mental incapacity.

- Bonds can be set up as a dedicated investment for education funding of children, and to work around any potential future issues that may arise due to divorce or family dissolution. Grandparents can have peace of mind that their grandchildren’s futures will be protected regardless of any future disputes arising from marriage breakdown or other unforeseen circumstances.

A simpler alternative to family trusts and deceased estate arrangements

The legal structure, taxation and other features of Education Bonds can make them a tax-effective, simpler alternative to family and discretionary trusts for meeting education objectives.

With the discretion to appoint up to 10 education beneficiaries and flexibly make education benefit claims for some or all of them, Education Bonds can operate like your client’s own education-purposed family trust, while retaining all the features and tax benefits of a traditional Education Bond.

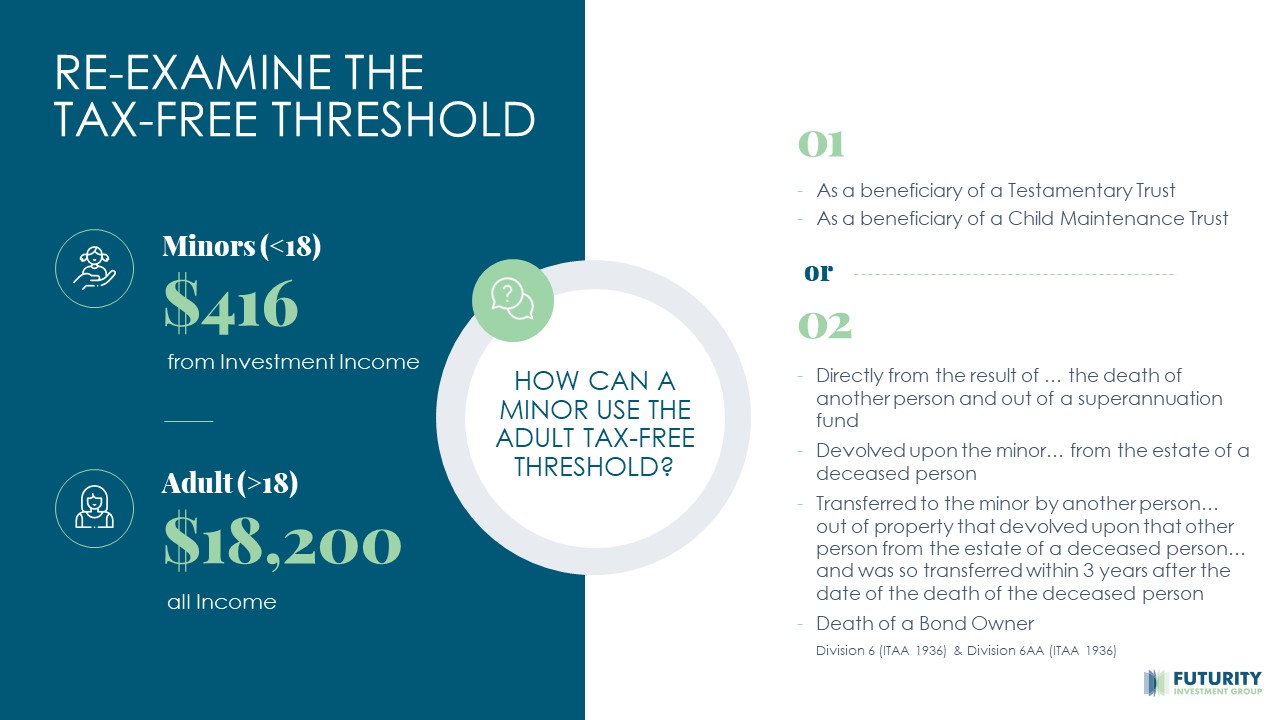

An Education Bond can also be a tax-effective, low maintenance alternative to testamentary trusts. Children that receive testamentary (inherited) benefits can invest in an Education Bond and be taxed at the adult tax-free threshold ($18,200 p.a.) instead of the minor tax-free threshold

($416 p.a.).

Case Study - David & Mary

Estate planning and alternative trust benefits of an Education Bond explained

After retiring, David and his wife Mary want to establish an education funding legacy for their five grandchildren (and any future grandchildren). Rather than using a family or discretionary trust, they invest $500,000 into a Futurity Education Bond because of its simplicity and tax management efficiency. They appoint their daughter as Bond Guardian so that in the event of both their deaths, the Bond will continue according to their wishes.

One year after investing, their Bond balance is $540,000 comprising $40,000 earnings and their original $500,000 capital. They decide to withdraw $10,000 to pay school fees for 11-year-old granddaughter Jenna.

Given that children under 18 can only earn $416p.a. of investment income before they are taxed at up to 66%, they are able to manage how much of the $10,000 withdrawal is taken from investment earnings to ensure Jenna pays no tax.

This is done by claiming $416 in earnings and taking the balance ($9,584) from capital. Because education purposed claims from investment earnings automatically generate an education tax benefit of 30%, $125 (representing 30% tax on $416) is paid as a tax benefit and the earnings balance only reduces by $291*.

The end balance of David and Mary’s Education Bond is $530,125.

In summary:

Bond opening balance: $540,000

Less $9,875 for Jenna’s school fees ($291 from earnings and $9,584 from capital)

Bond end balance: $530,125

The Education Tax Benefit of $125 is added back to the earnings account within the Bond, and is not deducted from the Bond balance.

Should David and Mary pass way:

- Education funding continues for their grandchildren

- Their daughter as Bond Guardian takes control of the Bond (authorisation controls can be set prior) and can add or remove beneficiaries

- The Bond becomes a de-facto testamentary trust with the adult tax-free threshold ($18,200p.a.) applying to the grandchildren – the same $10,000 withdrawal (this time by the Bond Guardian) would result in:

Bond opening balance: $540,000

Less $10,000 for Jenna’s school fees ($7,000 from earnings and $0 from capital)

Plus education tax benefit: $3,000

Bond end balance: $533,000

In this scenario, while Jenna has had $10,000 used to pay for school fees, the balance of the Bond is only reduced by $7,000. This is because the Education Tax Benefit of $3,000 does not come from the Bond balance.

More information

Whatever your client’s wishes, a Futurity Education Bond’s financial and estate planning features can give them control over how their wealth is distributed. Providing them with peace of mind that their wishes will be carried out. For more information on Futurity Education Bonds, call our National Business Development team on 1300 345 456, or go to Financial Advisers.

*Intergenerational Wealth Transfer: The Opportunity of Gen X & Y in Australia, Authored by Mark Brimble, Katherine Hunt, Dianne Johnson, Kirsten MacDonald, Griffith University.

Product issuer is Futurity Investment Group Limited, ACN 087648879, AFSL 236665. We provide general advice only and do not take into account any individual’s objectives, financial situation or needs. Financial advisers remain responsible for advice provided to their clients. The Product Disclosure Statement (“PDS”) is available here or by calling 1300 345 456 and should be read in full. The 6 % p.a. used in the case study is for illustrative purposes and assumes a long term investment timeframe and is net of fees and Fund Tax. It is not an indication of expected returns, nor is it a financial forecast or prospective financial information. Any taxation information is current as at the date publication and is based upon our general understanding of relevant taxation laws. Changes to these laws and applicable tax rates may impact the Education Tax Benefit, Tax-Free Thresholds, MTRs and the application of benefits associated with Investment Bond Tax Rules.