You can read the latest articles and insights to help you understand the strategic uses of Education Bonds to provide the best financial advice to your clients.

Unlock Potential

Accumulating and protecting wealth

Showing value to your clients is all about taking the time to understand their needs and offering unique solutions. When you can recommend a strategy to your client that is well suited to their unique lifestyle goals, while meeting multiple financial goals, including wealth creation, estate planning and tax effectiveness, you know you’ve found an investment solution that’s unique.

More and more Financial Advisers are now considering Education Bonds as part of their clients’ comprehensive financial plan. This is because Education Bonds are a unique tax-advantaged investment solution that your clients, predominantly who are parents and grandparents, can utilise to meet their financial challenges when it comes to education affordability. But it goes much further than that. Futurity’s Education Bonds can help your clients with a solution to:

- fund lifelong education,

- accumulate and protect wealth tax-effectively,

- provide for their children or grandchildren’s future, and

- pass on wealth exactly as intended.

Let’s look at some of the tax advantages of Education Bonds in more detail. As there’s lots of great benefits for your clients to love including:

- tax-paid investing benefits

- Special Education Tax Benefits

- no annually-generated taxable ‘assessable income’, so they can convey benefits when held as investment assets inside family and testamentary trusts

- no Capital Gains Tax

- no TFN required

- no reporting in individual tax returns

- flexibility to tax-effectively apply investment earnings across individual or multiple beneficiaries.

Tax-paid investing the simple way

Futurity pays tax on your client’s (Bond Owner) behalf on ongoing investment earnings at a rate of 30% throughout the term of the investment (up to 99 years). With franking credits and other offsets reducing the actual rate paid to averages of 18 to 25%.

Clients on higher marginal tax rates can benefit greatly from a tax-paid Education Bond, compared to other investments, such as bank accounts, managed funds and direct investments, which require tax to be paid by the investor.

Education Bonds are also nice and simple for you to manage from an administrative perspective because they don’t distribute income or capital gains. While the Bond is growing in a tax-paid environment, you avoid the hassle of cumbersome tax reporting.

Education Tax Benefit

Whenever a withdrawal for education purposes is made, Futurity makes an internal tax deduction on your behalf and refunds the tax already paid on ongoing investment earnings. Effectively, your client receives back a 30% tax refund when withdrawing from earnings to pay for education expenses.

This Education Tax Benefit is a special concession for education funds in Tax Law, designed to return or offset the tax already paid within a Bond. It amounts to an additional $3,000 for every $7,000 withdrawn from Bond investment earnings as an education benefit.

Plus withdrawals for education purposes are tax assessable in the beneficiary’s hands at their marginal tax rate, rather than in the hands of your client, the Bond Owner. So depending on the age of the education beneficiary, the education benefit will be tax-free. Or some personal tax may be assessable but only at the education beneficiary’s marginal tax rate. Giving you, as an Adviser, the solution to help your client manage the tax for any withdrawals from the Bond.

Avenues for accessing the beneficial tax-free treatment

There are three ways to access Bonds that give rise to tax-free treatment of distributions:

- The capital component of withdrawals made for any purpose is tax-free at any time

- The earnings component of withdrawals made for education purposes is also tax-free if planned correctly.

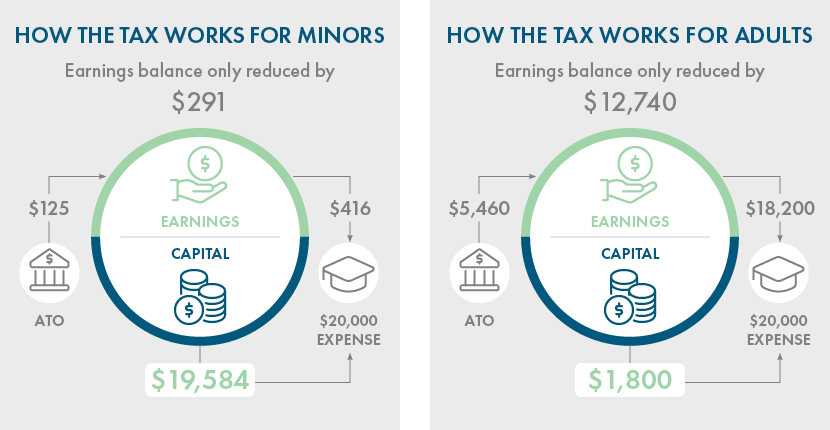

When withdrawing to pay for an education expense, your client can choose how much is withdrawn from capital and how much from earnings. Investment earnings withdrawn is tax- assessable in the hands of the education beneficiary. How this works in action for minors and adults to ensure the best tax outcomes is illustrated in the diagram below.

- The earnings component of withdrawals made for purposes other than education is tax-free after 10 years. Prior to 10 years, advantageous investment bond tax rules apply.

If you withdraw investment earnings within the 10 year period, an apportioned amount (as detailed above) will count as part of your assessable income and be subject to tax at your marginal rate. But you will be entitled to receive a 30 percent tax rebate on the assessable amount, to compensate for the tax already paid by us on fund earnings.

Flexibility to tax-effectively apply earnings across individual or multiple beneficiaries

Education Bonds offer the discretion to appoint up to 10 education beneficiaries, and the ability to add or remove beneficiaries at any time, giving your client more flexibility to apply investment earnings where it’s most tax effective.

Estate planning and testamentary benefits

As a Financial Adviser, you may be seeing the large majority of your clients nearing retirement age. But what we do know is that attitudes to money are passed down to future generations. So there is a considerable upside for you to start bringing the younger generations into financial discussions earlier. Particularly because an estimated $3.5 trillion will be handed over from baby boomers to younger Australians in the next 20 years*. So putting younger people in the best position to take greater control over their finances when the time comes for them to inherit the family’s accumulated wealth can be beneficial.

Education Bonds can be a great way to help provide for secure estate planning strategies as well as intergenerational wealth transfers. This is because Education Bonds can be a tax-effective, low-maintenance alternative to family trusts and testamentary trusts (created under a Will) to provide education funding for children and grandchildren.

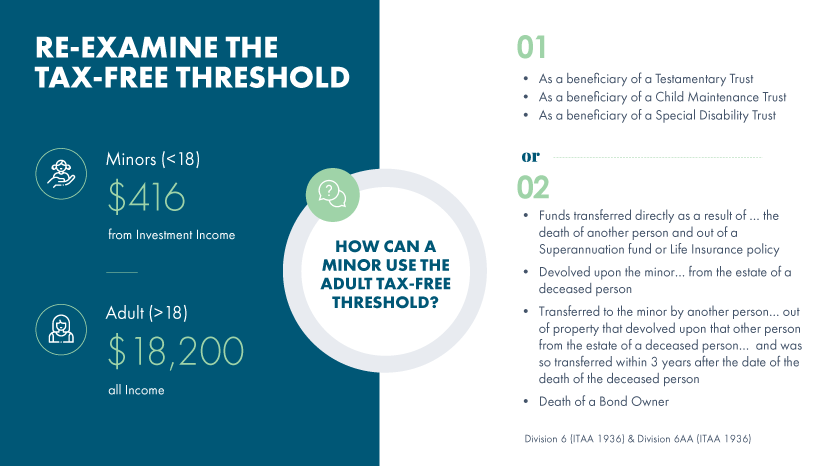

As the illustration below shows, children who receive testamentary (inherited) benefits can invest in an Education Bond and be taxed at the adult tax-free threshold ($18,200 p.a.) instead of the minor tax-free threshold ($416 p.a.).

For more information on the estate planning and testamentary benefits of Education Bonds, see Futurity Education Bonds: The simple way to pass on wealth exactly as intended.

Futurity Education Bonds are more than a savings plan and give the certainty and control you want for your clients. They offer a unique tax-effective solution for accumulating and protecting wealth across a range of life events and goals. For further information, contact our National Business Development team on 1300 345 456, or go to Financial Advisers.

*Research from Griffith University estimates that over the next 20 years, Australians aged over 60 will transfer an estimated $3.5 trillion in wealth.

Product issuer is Futurity Investment Group Limited, ACN 087648879, AFSL 236665. We provide general advice only and do not take into account any individual’s objectives, financial situation or needs. Financial advisers remain responsible for advice provided to their clients. The Product Disclosure Statement (“PDS”) is available here or by calling 1300 345 456 and should be read in full. The 6 % p.a. used in the case study is for illustrative purposes and assumes a long term investment timeframe and is net of fees and Fund Tax. It is not an indication of expected returns, nor is it a financial forecast or prospective financial information. Any taxation information is current as at the date publication and is based upon our general understanding of relevant taxation laws. Changes to these laws and applicable tax rates may impact the Education Tax Benefit, Tax-Free Thresholds, MTRs and the application of benefits associated with Investment Bond Tax Rules.