You can read the latest articles and insights to help you understand the strategic uses of Education Bonds to provide the best financial advice to your clients.

Investment

Navigating the shifts in Super to build wealth

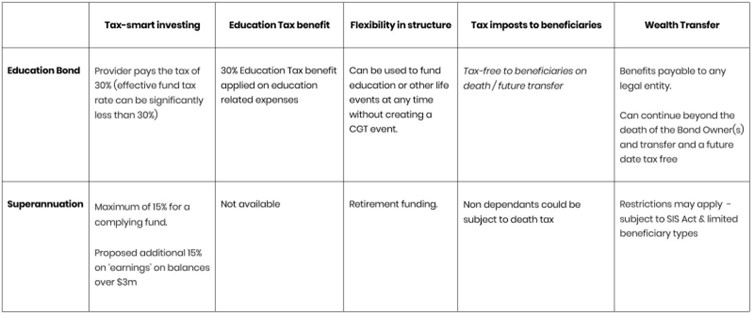

In today’s ever-changing landscape, where Superannuation regulations are constantly shifting, it’s essential to consider alternative avenues for tax-effective wealth building. While the proposal to cap concessionally taxed superannuation balances at $3 million may impact only a small portion of Australians, it highlights the complexity and volatility of the superannuation system.

We all know tax is often the largest ‘cost’ clients pay in relation to their investments, so it’s no surprise that Financial Advisers are increasingly exploring alternative tax-efficient investments outside of Superannuation, which itself remains a primary strategy for Australians to maximise retirement income.

One such alternative gaining attention is the insurance bond category, which includes Education Bonds.

Education Bonds offer discrete advantages over Superannuation in terms of flexibility regarding contributions, access to funds as well as assurance around estate planning and wealth transfer. Unlike Superannuation, Education Bonds provide additional tax benefits related to education expenses and offer a more flexible structure, allowing capital access at any time for any purpose.

Now, let’s delve into the details.

Tax-Smart Investing

Education Bonds present tax-smart investment benefits, including:

1. Education Bonds are Tax-Paid investments. This means that throughout the entire Bond Term of your investment, the product provider (rather than the investor) pays the tax (called Fund Tax) on your Bond’s ongoing investment earnings.

Tax-Paid investments can have valuable tax rate ‘arbitrage’ benefits. This is because effective Fund Tax rates (that the provider pays) on the Bond’s Investment Options may be lower than their higher ongoing personal MTRs (that the investor pays).

Education Bonds, are non-distributing investments and whilst accumulating, do not add to the Bond Owner’s personal taxable income from year to year. The impact of investment earnings automatically being reinvested and compounding in a Tax-Paid investment structure can add up to significant additional performance benefits.

2. Capital Gains Tax (CGT) Implications: Switching investment options or transferring ownership of the Bond does not trigger CGT implications.

3. No burdensome annual tax return requirements: Unlike other investment options, Education Bonds do not impose onerous annual tax return obligations.

So, what sets Education Bonds apart from Superannuation tax-wise? The Education Tax Benefit.

Education Bonds qualify for advantageous ‘scholarship plan’ taxation treatment.

Withdrawals from an Education Bond for allowed educational expenses offer additional tax benefits beyond those available in Superannuation.

Withdrawals for eligible education expenses will benefit from an Education Tax Benefit, which represents tax already paid on the Education Bond. The benefit is equal to $30 for every $70 withdrawn from the Education Bond’s earnings component when used for education purposes. For example, a $10,000 claim for school fees generates a $3,000 education benefit – which the issuer conveys by paying $10,000 and only reducing the earning’s component by $7,000.

Unlocking Funds: Flexibility Beyond Superannuation

Compared to Superannuation, Education Bonds provide significantly easier access to funds. Let’s examine how:

1. The unique structure of Education Bonds, comprising both capital and earnings components, allows tax-free capital-only withdrawals at any time.

2. Education Bonds offer even greater flexibility by enabling tax-free withdrawals for education expenses at any time. However, such withdrawals must fall within the beneficiary’s tax-free threshold to avoid income tax implications.

Flexibility in Structure

Education Bonds offer the unique structure of beneficiaries.

- In a Family Education Bond, you can have more than one beneficiary.

- The Bond Owner(s) can add or remove beneficiaries at any time, not only at establishment.

- The Bond Owner(s) can then make discretionary distributions to any of the beneficiaries.

- Ability to invest into one Bond rather than multiple products to reduce complexity and potentially compliance and administration costs.

Ideas for Family Bonds

- Create multiple Family Bonds for each limb of a large family.

- Use Education Bonds as investment assets inside family trusts or education trusts or for a deceased estate investment.

- For simplifying complex Wills & legal estates - use a Family trust Bond as a tax-effective, low cost and low maintenance alternative to creating testamentary trusts for children under your Will.

- Use as a dedicated investment for education funding of children, such as in circumstances of a divorce or family breakup.

Wealth Transfer Certainty

Superannuation death benefit payment complaints made up almost 10% of overall complaints about Super received by AFCA in 2022, at 457 (almost 9 per week. This represents an increase of ~25% over the preceding 4 years. Education Bonds offer certainty and unrivalled flexibility as a wealth transfer vehicle and will help your clients avoid uncertainly in passing on their wealth.

As an example, upon the death of the Bond Owner, the investment proceeds of the bond become tax-free for the nominated beneficiary. These payments cannot be challenged or altered due to a contested Will, making them invaluable in complex family structures.

Education Bonds do not require burdensome binding death nominations, and compared to that of superannuation, there is no restrictions or requirements in relation to dependent, non-dependent, or companies, or even charitable trusts in terms of tax-free proceeds. This makes such strategies ideal for clients with a complex family or personal affairs.

Even in the event of the Bond Owner(s) passing away, the strategy can continue ‘beyond the grave’ through a Bond Guardian feature available in an Education Bond, unlike superannuation.

The Bond Guardian(s) follow the instructions left by the Bond Owners, without owning the asset, for example:

“Bond Owner 1 & Bond Owner 2 want their Family Bond to remain in place for the education needs of their grandchildren even if they pass away. They appoint one of their children as their Bond Guardian and he must administer the Bond in the best interests of the Education Beneficiaries. The wishes of Bond Owners continue to be fulfilled, ensuring their grandchildren’s education is looked after by their trusted son”

A Wide Range of Sophisticated Investment Options

Further adding to the merits of Education Bonds is the broad selection of professionally managed investment options offered by most providers. This breadth of choice allows for alignment with individual investment philosophies and customisation to meet the unique needs and preferences of clients.

In summary

Education Bonds offer enhanced flexibility, tax benefits and alternate strategies when compared to Superannuation. They are emerging as a compelling option for investors, especially considering the proposed changes to Superannuation. While Education Bonds may be lesser-known and more specialised, they can provide significant value in specific client circumstances.

Find out more about the uniqueness of Education Bonds and how they can help your clients here

Date August 2023