You can read the latest articles and insights to help you understand the strategic uses of Education Bonds to provide the best financial advice to your clients.

Investment and wealth transfers

Managing wealth transfer in a blended family

Families come in all shapes and sizes, each with their own dynamics and challenges. The ‘traditional’ couple with two children may no longer be the norm in the evolving Australian family landscape, which now includes stepfamilies, blended families, and grandparent-led families.

Author: Damien Otto, Futurity Investment Group

Published: Financial Standard Private Wealth Magazine March 2023

A portrait of Australian families

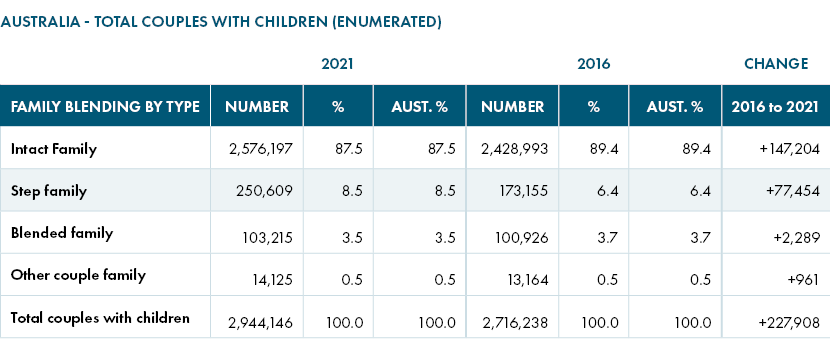

The Australian Institute and Family Studies found that step- and blended families comprise about 12% of modern family units.

Moreover, Australian Institute of Family Studies’ research found that in a stepfamily, there is at least one child who is the natural or adopted child of only one of the partners. Further, in a blended family there are two or more children of whom at least one child is the natural or adopted child of both partners and at least one child who is the stepchild of one of them.

In relation to children in non-parental care, Australian Institute of Health and Welfare data found that grandparent-led families, which are defined as a family where there is a grandparent-grandchild relationship and no parent-child relationship, are becoming increasingly prevalent—the Australian Bureau of Statistics (ABS) 2016 Census found there were more than 60,000 grandparent families in Australia.

Source: ABS, Census of Population and Housing 2016 and 2021.

Compiled and presented by .id (informed decisions).

Managing family finances in a family unit

Managing finances is one of the main challenges faced by any family. There are many aspects to consider and hard choices to be made around questions ranging from how you would like to pay for education needs and save for the future, to how you would like to divide your assets or provide for a surviving partner and children.

Blended families are no different, only they can be more complicated. It is important to acknowledge these potential complexities and plan for the protection, control and transfer of wealth.

Many individuals find that when they remarry, combined assets, incomes, and personal resources help to provide an instant sense of security At first glance, this pooling the resources by both partners may make financial sense, as it can create a more stable financial base for the family than could otherwise be provided as single parents.

However, blended families and stepfamilies also often face complex challenges while building and protecting their wealth. A possible scenario is when parents attempt to protect and provide for their children from a previous relationship while also providing for a new spouse. If the new spouse also has children from a previous marriage, the situation may become further complicated.

Inheritance feuds on the rise

When children do not share the same parents and grandparents, sometimes things can become complicated, especially when it comes to wealth transfer.

The rise in the number of blended families is quoted as the cause for the sharp increase in inheritance feuds. A December 2019 article by Duncan Hughes titled ‘Big increase in inheritance feuds among blended families’ published in The Australian Financial Review found that over the past 10 years, legal battles over inheritances have increased 80%. While family disputes are thought to account for about eight in 10 of all legal actions, legal cases involving blended and estranged families now constitute the vast majority of disputes over Wills.

In blended and stepfamilies, arguments over inheritance are not just a symptom of sibling rivalry. Disputes can occur between surviving partners or spouses and children, while grandparents are also often seen taking a stand against the surviving spouse and children.

Experts agree that the secret to successful intergenerational wealth transfer is planning and preparing both children and grandchildren for the kinds of responsibilities they may face in the future. For example, when they take over the reins of a family business.

Applications of education bonds

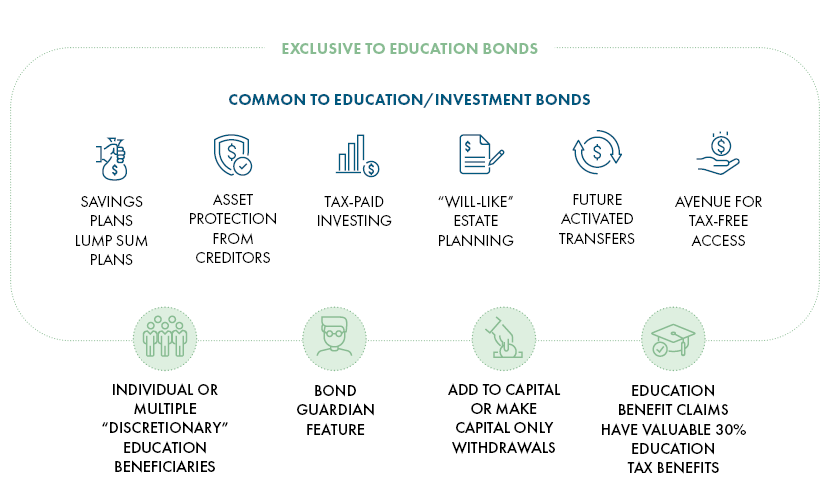

Many people think an education bond is a type of investment bond. However, this is not quite accurate, even though the name is similar. An education bond is a tax-effective investment product designed to help meet the cost of education.

As long-term, growth investments, education bonds can help parents and grandparents attain financial self-sufficiency for their lifelong education goals—whether for themselves or their families.

Education bonds are investment-linked life insurance contracts between the bond-owner and the issuer. Only friendly society-based life companies can issue them—and they carry strong legal protections and security measures under the Life Insurance Act 1995 and stringent Australian Prudential Regulation Authority prudential supervision.

Education bonds are designed to tax-effectively save and invest to accumulate the funding for education-purposed objectives. The flexible structure gives bond-owners full control and access to their funds at any time, both for making education benefit claims and withdrawals for any purpose.

Further, education bonds offer a level of comfort when it comes to estate planning by providing certainty for how and when wealth will be distributed, with Will-like bond estate nominations to achieve tax-effective inheritances.

Further, they can include the ability to:

- access the capital component (i.e. money contributed as opposed to bond earnings) tax-free at any time

- access the education tax benefit

- add or remove beneficiaries at any time

- add a bond guardian.

Education bonds vs investment bonds: Commonalities and differences

Education bonds have taxation benefits and can provide superior ‘after-tax’ investment outcomes against other investment types.

Tax-free contributions

Money paid into the education bond does not attract any tax and can be accessed at any time.

Thirty-percent education benefit

As an illustration, Futurity pays tax on the bond’s ongoing investment earnings at a tax rate of up to 30% on your behalf. When the bondowner makes a withdrawal to fund education, they will enjoy a refund of the tax paid by the issuer, which gives the bondowner an extra $30 for every $70 dollars withdrawn.

Tax-free components

There are various avenues for accessing education bonds. Distributions to bondowners, their education beneficiaries and estate are made tax-free if planned correctly.

Lump sum contributions are allowed as well as regular monthly contributions, thus the benefits of compounding within a low-tax environment can be maximised.

They are also free from the often-burdensome annual tax reporting required with other types of investments.

Dividing wealth without dividing the family

Family education bonds can help parents and grandparents in step and blended families manage financial complexities.

For these purposes, family education bonds:

- can work like your own special purpose ‘education’ family trust to simplify some of the complexities of Wills and estates

- allow creation of multiple family bonds for each limb of a large family group or for philanthropic purposes

- have a flexible structure that gives bondowners full control and access to their funds at any time allowing them to make choices and plan ahead to ensure their beneficiaries, or a single beneficiary, receive a benefit for education and non-education purposes tax-free

- may be used as investment assets inside family trusts or education trusts or for deceased estate investments

- may be used as a dedicated investment for education funding of children, say in the circumstance of a divorce or family breakup

offer a tax-effective, long-term investment strategy.

In summary, education bonds’ built-in financial and estate planning features can give you control over how your wealth is distributed and help provide certainty that your wishes will be carried out.

More and more Australians are effectively using education bonds to transfer wealth. The following case studies show some of the applications.

Shoring-up bequeathment wishes through non-estate assets

Jeremy recently celebrated the birth of his third child with his new wife Stacey. As part of his estate planning, Jeremy wanted to ensure his eldest two children from his first marriage were supported financially after his death.

An education bond allowed Jeremy to invest $600,000 and nominate his two eldest children as the only beneficiaries. Importantly for Jeremy, his two eldest children will have the option of receiving a lump sum or drawing an income from the education bond. As the education bond is a non-estate-asset, Jeremy’s new wife, Stacey, will not be able to challenge the transfer of wealth to his eldest two children at the time of his death.

Specifying a purpose

Jackie, a farmer in rural Victoria recently spoke to her financial adviser about setting some money aside for her five grandchildren, but also having access to capital for a future non-education purpose withdrawal.

An education bond allowed Jackie to set aside more than $100,000 for each grandchild. A guardianship clause can be used to restrict Jackie’s five grandkids from accessing the funds until their 26th birthday, unless the money is used for education purposes, including school fees and university expenses.

Maximising tax benefits for minors

Ted was in the process of setting up an education bond for his grandchildren when sadly he passed away.

Because a death benefit had been invested for minors, the grandchildren are subject to adult tax rates (there are higher rates and different tax-free thresholds for minors), which means they can withdraw earnings from the education bond, similar to the structure of a testamentary trust.

This allows for the possibility of a grandchild to withdraw $18,200 from any earnings tax free, allowing them to maximise use of the 30% internal gross up (that is, the fund pays 30% tax), equating to an approximate credit of $5,400, back into the education bond.

To elaborate and as an illustration, when an education benefit claim of $18,200 (that is, the adult tax-free threshold) made for the grandchild from the earnings component of the education bond, and as the funds are being used for education purposes, the beneficiary receives a 30% tax benefit. This tax benefit represents a refund of the tax already paid by Futurity on the investment earnings and is equal to $30 for every $70 withdrawn from the earnings component of the bond.

So, $18,200 is received by the beneficiary but the bond balance only reduces by approximately $12,800, with $5,400 representing the education tax benefit amount.

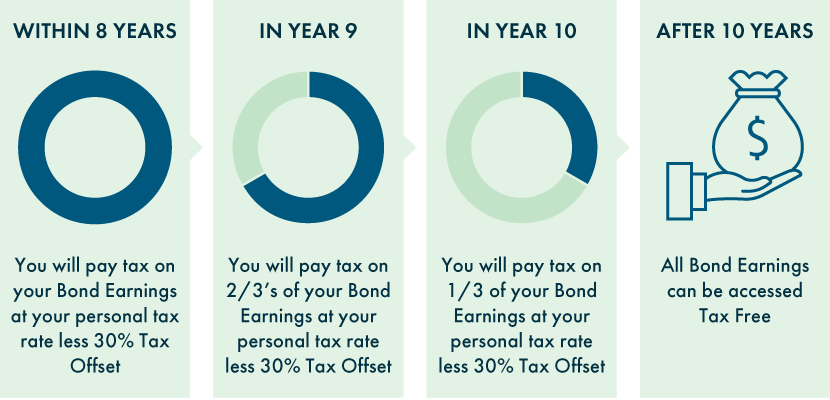

As with an investment bond, if the bondowner accesses any investment earnings after 10 years from the date of their initial contribution, and they also satisfy the 125% rule which requires the bondowner to keep the bond’s ongoing level of savings or any add-on contributions to no more than 125% of the previous bond year’s total contribution level, the amount the bondowner receives will be tax-free in their hands.

Tax rates for education bond earnings withdrawn within 10-year period

When making other withdrawals (any purpose)—the bondowner can choose whether they are sourced from their capital component or whether investment bond tax rules will apply. As these types of withdrawals can be used for non-education-related expenses, it will not be increased by the education tax benefit in the same way as for education benefit claims.

Expertise in practice

Dominic Alafaci is the founder and director of Collins House Private Wealth which provides a multidisciplinary approach to assisting clients achieve their lifestyle and financial goals.

He has found that transferring wealth effectively can be challenging, even without the complexities that blended families bring to the table.

Financial advisers need a full understanding of the key stakeholder’s relationship with money and how and to whom they would like it transferred. Education bonds can provide certainty and flexibility with the ability to nominate up to 10 beneficiaries in a tax-effective testamentary-trust-like structure.

Effective wealth transfer is a key driver for many of Alafaci’s private wealth clients, but there are ramifications for getting things wrong, particularly, tension, tax and turmoil.

To help alleviate potential headaches, an education bond structure ensures wealth can be transferred to beneficiaries automatically upon the death of the bond owner, or at a future set date.

Further, it is possible to transfer an education bond at any time to one or multiple individuals, and even to other entities, such as a company. These transfers enable tax-effective intergenerational wealth transfers. These can be done while the Will-maker is alive, with immediate effect, or they can put in place arrangements for some point after the date of their death. Education bonds also offers a down-the-line survivorship option.

Education bonds can offer a regular savings plan for education (and separate money for this purpose, especially in the event of divorce), which provides tax benefits, certainty and efficiency in wealth transfer.

Grandparents can also use education bonds to transfer wealth, by setting up a family education bond and nominating up to 10 beneficiaries who will receive the funds upon their death (no tax event). In these circumstances, the funds also become testamentary in the education bond, so the adult tax-free threshold applies for minors.

To find out more about how a Futurity Education Bond’s unique tax structure and flexibility could help your clients successfully manage wealth transfers now and post death please contact our National Business Development Team.