Education and Investment

Investment Bonds vs Education Bonds – What’s the difference?

Education is the key to unlocking opportunity and a brighter tomorrow. And a good education, including one that extends beyond high school, costs money.

That’s why smart people plan for their children, their grandchildren, or even their own educational future by putting savings aside. While there are lots of ways to set up an education fund, Investment Bonds or Education Bonds are often a consideration.

While they may seem similar to the casual observer, there’s some major important points of difference you should know about.

Let’s look at the differences between Investment Bonds and Education Bonds, and explore how Education Bonds work.

What is an Investment Bond?

Not to be confused with Corporate or Government Bonds, an Investment Bond is a flexible, tax-effective investment product to help you achieve your long term financial and estate planning goals.

An Investment Bond acts like a combination of a life insurance policy and a managed fund. Where the amount you invest is pooled with others and invested in a range of asset classes. Often with a choice of investment options to be selected based on your risk profile, time horizon and financial objectives.

How does an Investment Bond work?

Investment Bonds are tax paid investments. This means when earnings are received, the bond issuer pays an effective tax rate of up to 30%. Because of this, Investment Bonds can make an attractive option for those on marginal tax rates higher than 30%.

One of the stand out features of an Investment Bond is that after 10 years, and if you do not exceed the 125% rule in terms of contributions, you can withdraw the value of the bond with no further tax being payable. Plus there is no requirement to declare interest or capital gains in your personal tax return.

The 125% tax rule requires you to keep your Bond’s ongoing level of Savings or any Add-On Contributions to no more than 125% of the previous Bond year’s total Contribution level. Adherence will preserve its qualification for the Investment Bond 10-Year Advantage.

Why choose an Investment Bond?

Many financial advisors suggest investing in Bonds as a way to diversify an investment portfolio. This is known as strategic investing and involves taking a long term approach to creating and building wealth.

If you’re looking for a long term, risk averse investment to balance your investment portfolio, Bonds could be a sound financial choice.

What’s an Education Bond?

Many people think an Education Bond is a type of Investment Bond. However, this is not quite accurate, even though the name is similar.

In our Futurity Education Bonds PDS, we state an Education Bond is used for saving and investing to tax-effectively accumulate funds for meeting education expenses.

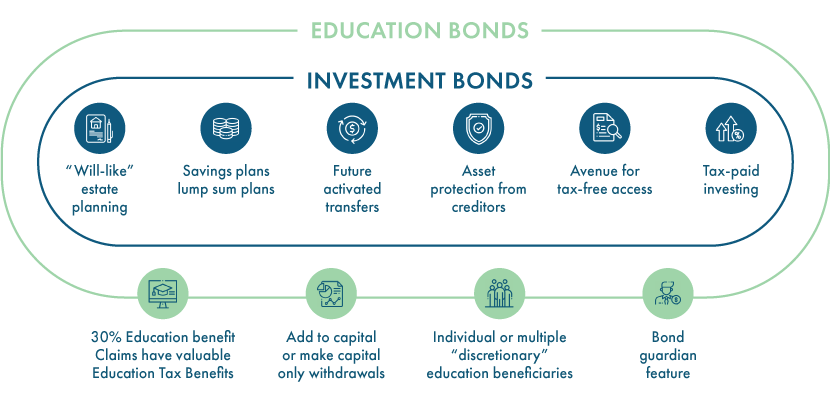

Features of both an Education Bond and Investment Bond

- Savings plans / lump sum plans

- ‘Will-like’ estate planning

- Future activated transfers

- Asset protection from creditors

- Avenues for tax-free access, and;

- Tax paid investing.

How do Education Bonds work?

An Education Bond is a dedicated, tax effective investment for education, but can also be used for other purposes. It can be for yourself but most people use an Education Bond to invest in the future of their children or grandchildren.

Offering all the features of an Investment Bond, an Education Bond also has special Education Tax Benefits, Estate Planning features and the discretion to appoint multiple Beneficiaries.

An Education Bond is an excellent way to ensure the money you set aside to invest for your loved ones will be passed on as you intended.

So, what makes Education Bonds a wise choice?

Tax free contributions – money paid into the Education Bond doesn’t attract any tax and can be accessed at any time.

30% Education Benefit – Futurity pays tax on the bond’s ongoing investment earnings at a tax rate of up to 30 percent on your behalf. When you make a withdrawal to fund education, you’ll enjoy a refund of the tax paid by us which gives you an extra $30 for every $70 dollars withdrawn.

Estate planning features – investments made outside the proceeds of a Will can be a smart decision. An Education Bond is an excellent way to ensure the money you set aside to invest in the educational future of your children or grandchildren will do just that.

Appointing multiple beneficiaries – ‘Will-like’ tax-effective inheritances mean Bond earnings are given to your chosen nominees on a tax-free basis and in line with your wishes.

Access Capital tax free – Any withdrawals sourced from your Bond’s Capital Component will be tax free. Your Capital Component comprises your Contributions made from money you have already personally paid tax on or are capital sums.

The graph below shows clearly what benefits overlap with an Investment Bond and what is unique for an Education Bond.

Why invest in an Education Bond?

While public education in Australia is widely considered as free, even public schools are becoming more reliant on parent’s fees to stay afloat. Or parents are seeking out private education where private school fees can put a considerable dent in the family budget. Plus, a free higher education has sadly been lost to history.

With the rising costs of education, it makes sense to invest in your children’s education early. When you add in some very attractive tax benefits, a savvy investor knows a good thing when they see it.

When you invest in a Futurity Education Bond early, you’re not only investing in your children or grandchildren’s future, but you’re also accessing long term tax benefits for yourself and your entire family.

The information in this article contains general advice only and does not take into account your objectives, financial situation or needs. Before you act on any advice in this website please consider whether it is appropriate to your personal circumstances. You should also read the relevant Product Disclosure Statement which is available on our website, or you can obtain a copy by calling us on 1300 345 456.